Traditional Premium Finance

What it is:

A method to pay a life insurance premium when the client can make more on money with an alternative investment.

1. A loan the policy owner will have to list with their liabilities.

2. The owner will have to pay interest “out-of-pocket” until the loan is paid.

Why Premium Financing?

There are 3 reasons to consider financing a life insurance premium:

1. The owner/premium payer can make more by investing outside the contract than paying the premium directly.

2. Paying premiums will require liquidating investments resulting in lost growth, significant taxation or an unacceptable reduction in investment-opportunity capital.

3. The insured has exceeded his/her lifetime gifting exemptions and further gifts will result in gift taxes on the premiums (currently taxed at 40%).

Who is a Good Prospect for Premium Financing?

Generally, someone who understands the concepts of leverage and interest-rate arbitrage and has a need for large life insurance coverage is an excellent prospect for Premium Financing.

Is There A Minimum Premium?

Yes. Typically, the minimum annual premium is $100,000. Lenders are rarely interested in loaning lesser amounts.

Legal and accounting expenses associated with this approach will generally make funding lesser premium amounts unappealing to the insured.

What are some examples of large life insurance needs?

• Estate Tax Funding: Persons with large estates, particularly with illiquid businesses or assets.

• Business-Continuity Agreement Funding:

- Stock-Redemption Agreements

- Cross-Purchase Buy-Sell Agreements

• Estate-Equalization Funding for heirs outside the family business.

• Estate-Equalization Funding for members of blended families.

• Key-Person Insurance Coverage

How It Works:

The owner of a life insurance policy borrows the premium from a lender which will accept the cash surrender value (CSV) of that policy as collateral for the loan.

Since during the early years of the policy, the CSV is generally lower than the amount of the loan, additional collateral will be required.

Liquid assets are the only form of collateral that are acceptable to most lenders. Some even require the collateral be managed by them.

Interest is charged on the loan and is generally paid in advance

Most lenders loan at the London Interbank Offered Rate (LIBOR).

The rate can be 30-day, 90-day, 180-day or 1-year LIBOR plus an interest spread of 2.00% to 3.50%.

The amount of the loan and the creditworthiness of the borrower dictates the spread.

Loan Commitment:

Generally, up to 5 years; although some lenders go year-to-year.

Loan Underwriting:

As with any loan, lenders require financial justification. Typically, this takes the form of:

1. A loan application

2. Two to three years of tax returns

3. A current financial statement

4. The life insurance illustration to be financed.

Who makes these loans?

Generally, lenders fall into one of three categories:

1. Banks

2. Loan Companies, or

3. Aggregators using hedge-fund money or off-shore sources.

How does it work?

During Life

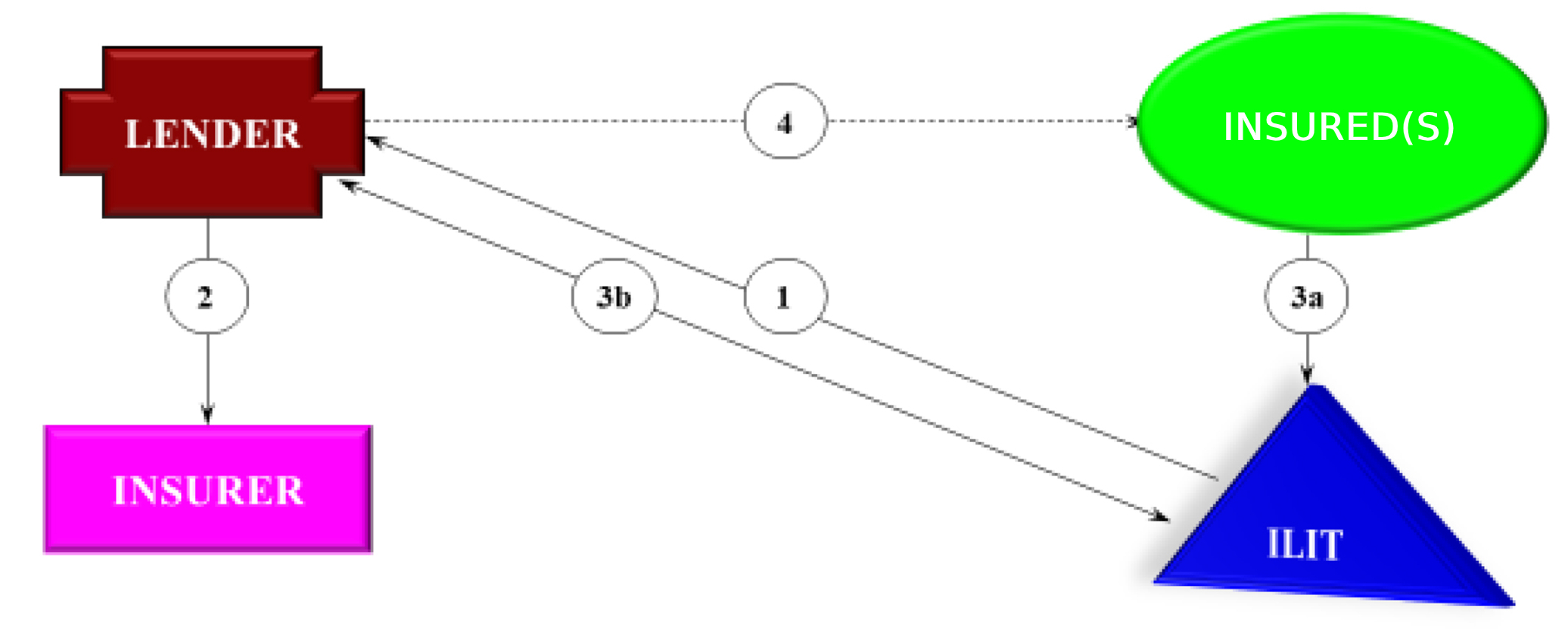

TRADITIONAL PREMIUM FINANCING

HOW IT WORKS DURING LIFE...

- 1) An entity established by the insured enters into a financing agreement with a lender to fund an insurance policy on the life (lives) of the insered(s).

- 2) Premium is paid by the lender to the insurer

-

3) Interest is paid quarterly or anually

- a) From gifts made to trust by the insured(s) or from trust assets

- b) By the trust at 30-day LIBOR + a 1.75% to 3.00% interest spread (can vary by lender)

- 4) The loan is recourse to the trust and collateral in addition to policy cash surrender value must be provided the lender in either cash, liquid securities or a stand-by letter of credit.

At Death

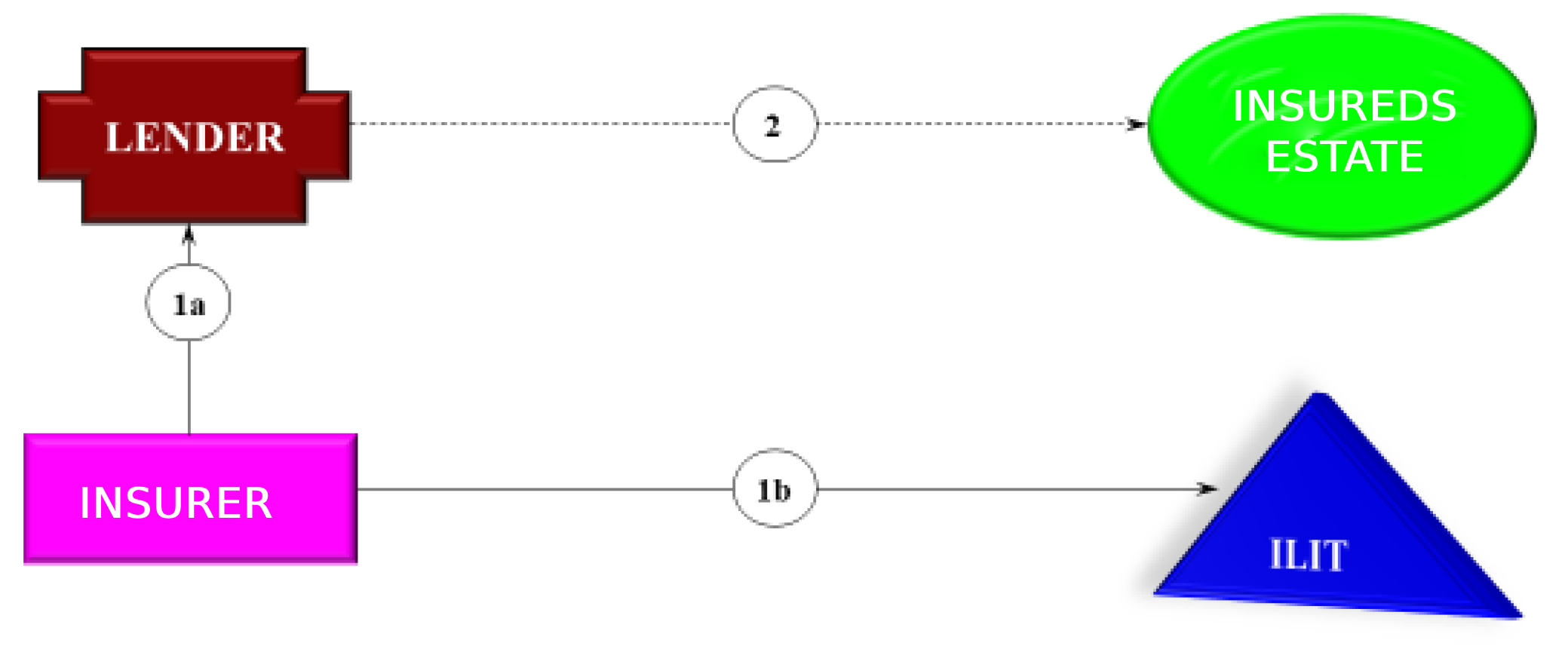

TRADITIONAL PREMIUM FINANCING

HOW IT WORKS AT DEATH...

-

1) Insurance proceeds are paid by the Insurer.

- a) To the lender (to the extent of the loan), and

- b) To the beneficiary (the remaining death benefit from the policy

- 2) The insured's estate is relieved of liability for the loan (if any) and collateral is released by the lender.

TOLL FREE: (800) 424-3978 DIRECT: (972) 247-5300 FAX: (972) 484-5981